The following data is sourced from either the statistical office of the European Union (Eurostat) or the ECB. The graphs and most of the text were originally created by the author for another work.

A picture is worth a thousand words

Finding the time to read the latest economic reports and analyses can be a challenging task for many of us. But how else are we meant to stay in informed and know all of the relevant economic data and trends? One word: charts. Without further ado, here are 15 charts that best describe the current economic situation in the eurozone.

Inflation

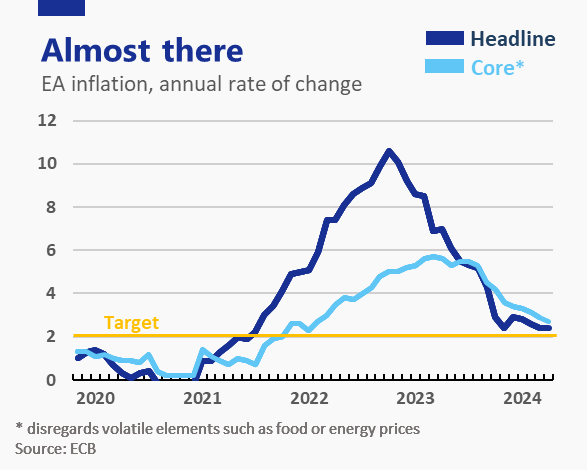

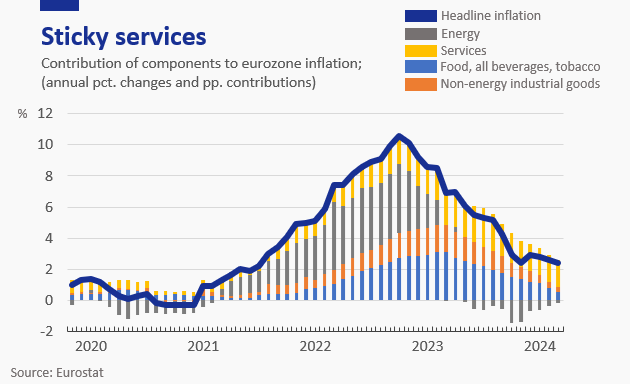

Tight financing conditions and the reversal of energy shocks seem to have tamed the record-high inflation figures between 2022-23. The energy crisis galvanized by Russia’s aggression on Ukraine is all but an unpleasant memory, with energy prices having deflated for the last year. Headline inflation currently stands at 2.4%.

Despite still visible price increases on grocery aisles (3.8%), most prices are indicating a strong disinflationary trend. Nevertheless, the fight against inflation is far from over. Several underlying price pressures remain in place that could risk a rebound in inflation given premature loosening policy.

Sticky services inflation remains the largest contributor to headline inflation, comprising 45% of the current consumer basket. As such, services remain the leading factor hindering the current disinflationary process.

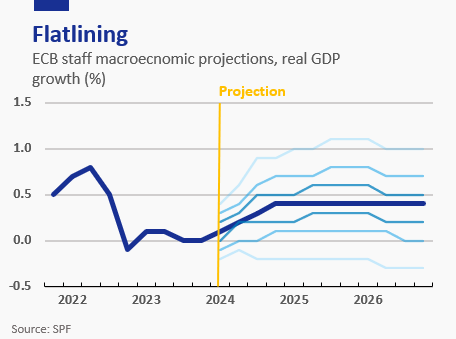

Growth

The euro area economy stagnated in the final quarters of 2023, although showed some surprising resilience as of Q1 2024 thanks to strong German exports. Economic growth previsions have been brought down to a meagre 0.4% for the upcoming years.

A persistent current account surplus has provided much-needed injections to the eurozone. Moreover, competitive exports that have created global demand for the euro (hence appreciating it) have mitigated the risks of imported inflation.

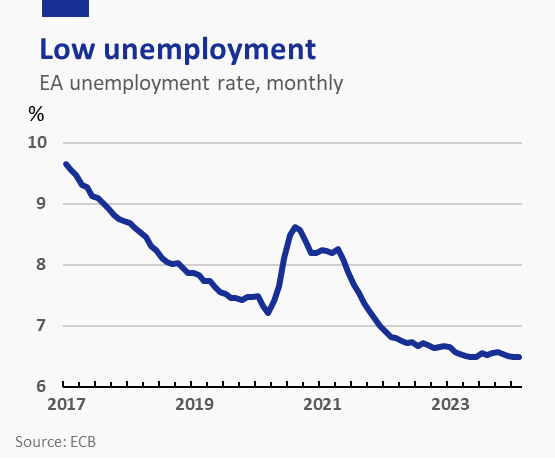

The Labour Market

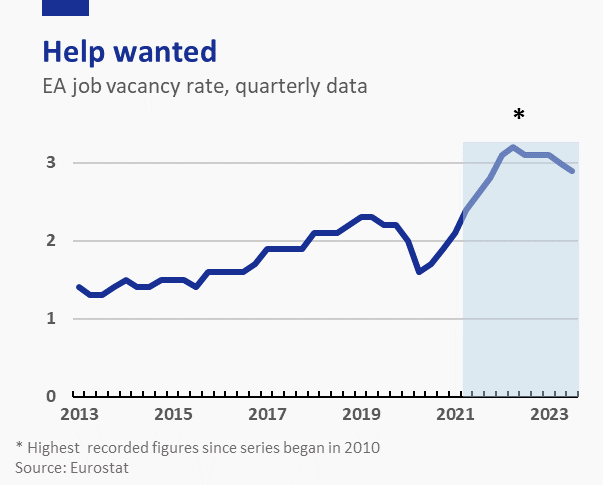

The labour market in the euro area is exceedingly strong. The unemployment rate stands at a record low of 6.5%, which has never been seen in the history of the euro before. Moreover, the labour force participation rate is equally strong, indicating active participation from all members of the working-age population. Despite low unemployment figures and active participation, labour supply has been slow to adjust to the growing needs of euro area producers.

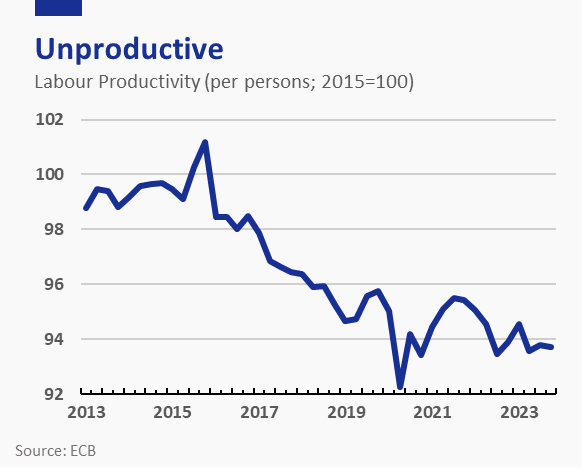

Skilled labour shortages remain the leading factor stunting growth in the euro area. This has been reflected as a persistently high job vacancy rate of 2.7%. Job vacancies weaken firms’ bottom lines and growth prospects; moreover, through having to hire unsuitable candidates to fill positions, skilled labour shortages relate to falling productivity across the euro area.

Productivity is at a falling trend in the eurozone. Apart from skilled labour shortages, it has been exacerbated by low rates of innovation and creative destruction, especially by the part of small and medium-sized companies (SMEs). SMEs comprise a majority share of all firms in the eurozone; due to having less access to economies of scale and adaptation to information technologies as their larger counterparts, they are more unproductive.

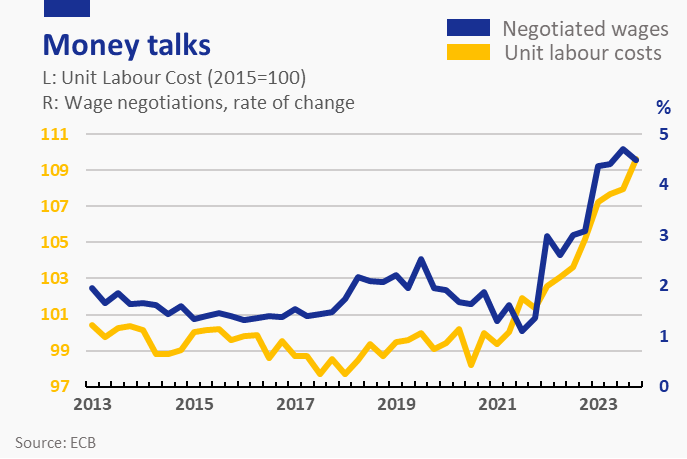

Low unemployment figures and high rates of skilled labour shortages give workers better leverage to ask for higher wages. This has been translated as a persistently rising trend in both the rate of growth of negotiated wages and unit labour costs. Naturally, rising costs exert cost-push pressures on domestic firms.

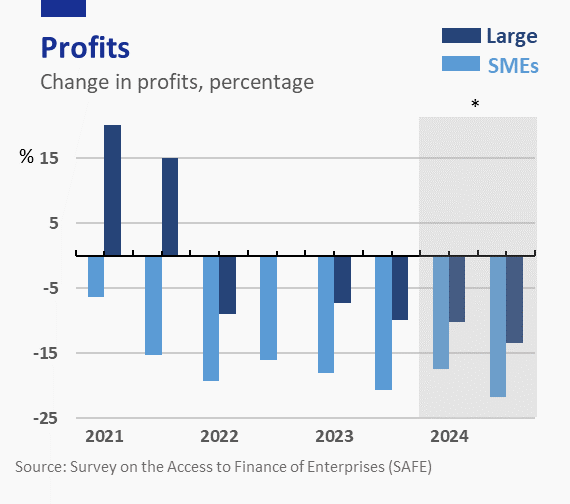

Firms’ profit margins will be a crucial determinant to see whether rising costs can be internalized by firms. Unsustainable profit margins will be either met with layoffs or price rises, the latter of which would result in cost-push inflation.

SMEs have found it more challenging to sustain their profit margins due to having less price-setting ability as large enterprises. Furthermore, although in 2023 firms were able to successfully internalize rising costs in their profit margins thanks to falling input costs (e.g. energy) in other areas, the expected normalization of these costs will increase the contribution of wage growth going forward. Moreover, low productivity figures could weaken firms’ ability to absorb rising costs in the long run.

Financial and Monetary conditions

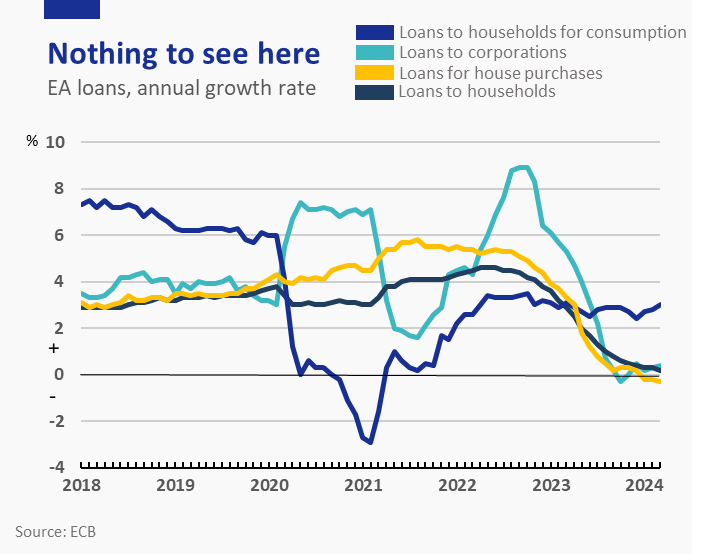

Tight financing conditions have kept money supply and demand for loans subdued in the euro area. Despite record-high bank profitability caused by elevated interest rates and rising net interest margins in 2023, a fall in bank profit margins can be expected in 2024 due to falling lending rates, elevated costs of acquiring equity and depreciating asset quality.

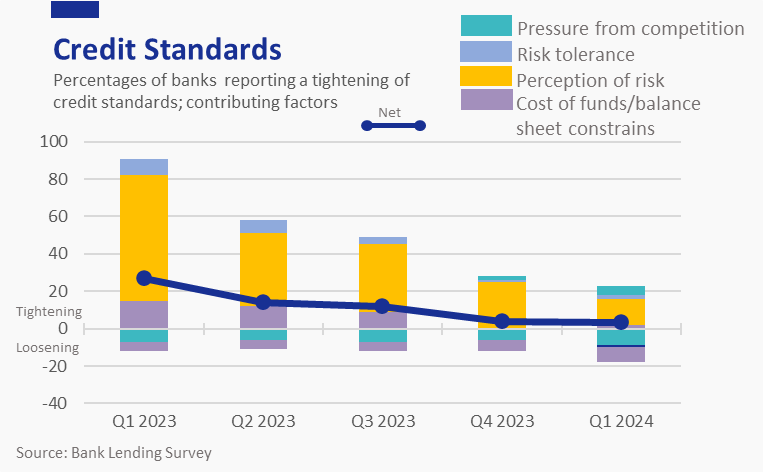

Furthermore, increased risk perception has prompted banks to adopt stricter credit standards in the last quarters. The latest Bank Lending Survey indicates a marginal tightening of credit standards, with loan growth rates remaining stable in the last quarters following a sharp decline between late 2022 and 2023.

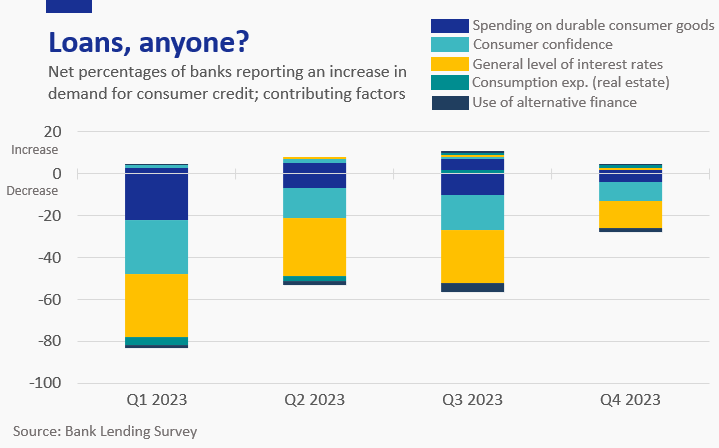

Downward pressure from low demand for loans is another contributing factor to the falling loan rate in the eurozone. Demand for consumer credit remained weak throughout 2023, although a gradual slowdown in low rates of demand between the first and final quarters of 2023 was perceived. Notably, consumer confidence and the general level of interest rates are the main factors thwarting demand.

Real estate

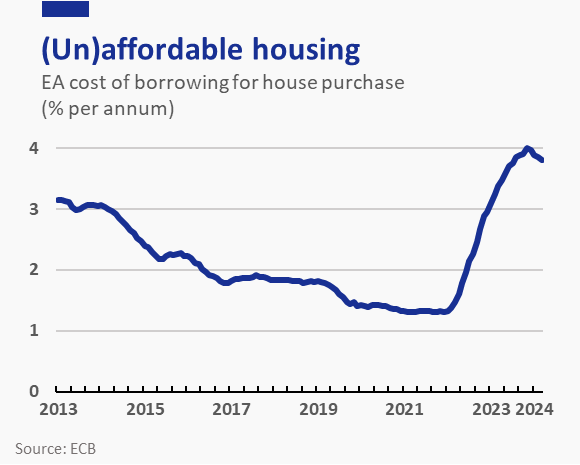

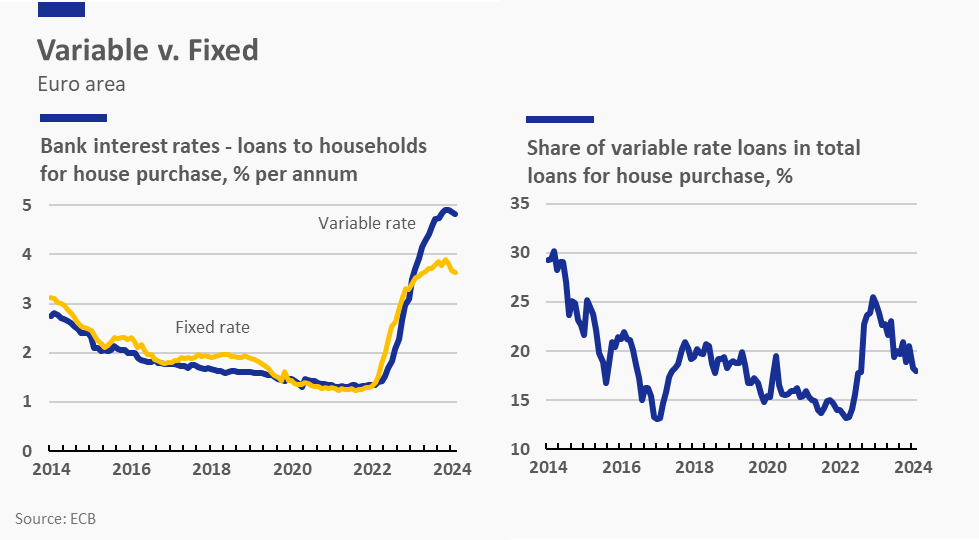

Real estate markets are another point of friction in the euro area economy. High interest rates necessary to tame inflation are being transmitted as sharply increasing costs to households for house purchase loans. Consumers on variable loans were especially impacted by staunch loan terms, although a strong labour market and strict credit standards have kept the non-performing loan ratio for SIs stable in the euro area.

Moreover, the share of variable rates in total loans for house purchases has been in a falling trend in the last decade, leaving more room for slow-to-adjust fixed rates. This lag becomes apparent when observing the data: fixed rates currently stand an entire percentage point below variable rates. As such, the impact of high interest rates is yet to be fully transmitted into financing conditions. Notably, vastly asymmetric credit compositions within the euro area will result in varying impacts of the transmission mechanism between member states.

Risk assessment

Geopolitical tensions in the form of the Russo-Ukrainian war and the rise in conflict in the Middle East remain the leading short-term external downside risks to growth and upside risks to inflation. Both rising freight costs and short-term energy shocks remain existing cost-push threats. Economic sentiment levels linked to these events are also worth considering.

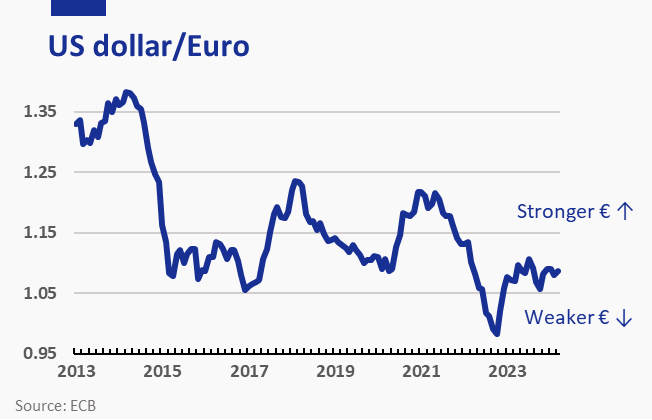

Moreover, a depreciating euro compared to the US dollar risks exacerbating the impact of short-term energy shocks. Rising oil prices, which are typically denominated in dollars, could result in an amplified inflation effect given a weaker euro.

Conclusion

The eurozone economy is marked by lacklustre growth and productivity figures. Tight financing conditions have kept demand in check, with inflation slowly nearing the ECB’s 2% inflation target; interest rate cuts can be expected in the upcoming months. Despite falling inflation, the labour market is hot as ever.

However, labour skill shortages are thwarting any chances at growth escaping its awkward „zero point X“ limbo. Much needed monetary loosening is being postponed by supply-chain vulnerabilities and the risk of flare-up in conflict in the Middle East.

The euro area economy is slowly grinding its gears, seemingly stuck in first gear. The traffic jam it has found itself in has slowly started to clear up; soon, it will join the freeway.

Note: this is a complete update of a similar post that was published a few months ago.

Leave a comment